We cannot predict the future and cannot see the future so that can we prepare for the future? How can we be positioning our investments? Answers to these questions lie in the understanding of the cycle and at where we stand at the current cycle.

It’s not always what we buy that matters but at what price we are buying that matters a lot.

These checklists help us to an understanding regarding cycle and where we stand at the cycle. That understanding helps us with what we should do and what can be the portfolio positioning. These checklists also help us to remove some mistakes such as buying little when risk is low so that capital allocation decision also can be improved. The capital allocation also one of the key elements to becoming a successful investor.

We all see the everyday events which were covered by the media but we also need to put effort to understand that what it is going to indicate to us. These efforts help a lot to us. I got saved in recent market turmoil due to understanding of the cycle which I have practised after reading “The Most Important Things”.

I want to quote my learning from the most important things here to explain this concept with a few additions.

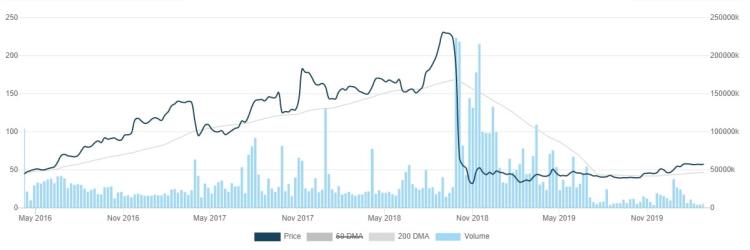

The earlier scene in the year 2017-18

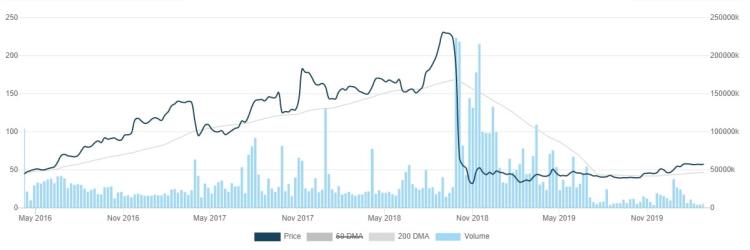

The current scenario in the year 2019-20

We need to focus on the current scenario what it is indicating to us, not to worry about the future. If the current scenario tells us to stay away and we are into the third phase of the bull market then we need to adjust our portfolio accordingly. And if the current scenario suggests the third phase of the bear market then we need to adjust our portfolio positioning accordingly. We cannot track each and every information flowing around the world but we need to understand which of them are important and help us to reach the conclusion.

When market and psychology of the investors flying then do not care for the valuations. People argue that old valuation techniques do not work in the current period. Another argument is that we should look at the business, not stock so that valuation does not matter. But what happens to this logic when bear take a charge?

Old technique again starts taking place. Higher P/E looks as an unhygienic for the health of the portfolio and low P/E tempted to the investors.

We can see that during the bull period even non-qualitative companies also traded at the multiple of quality companies.

There are qualitative and quantitative two phenomena which we can study to understand where we stand in the cycle. We always need to ask the question to ourselves how the assets priced and how the investors around us behave? That means the quantitative part refers to the valuation of the assets. And qualitative part refers to the behaviour of investors around us & understand it.

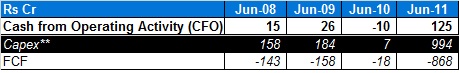

Example – one of the E-Commerce company of India

When the market is booming, the psychology of investors is positive, economy growing, people are eager to make an investment then low-quality securities also getting issued by providing a better rating.

We have to be contrarian, have to learn to go against the wind prevailing in the market.

When market falling, people tend to stay away from it. They argue that keep away from catching a falling knife. But when dust gets settled and we realize that the final bottom has made, a bargain will also be gone.

There is no way to know when and at what price exact bottom has made. We come to know about the bottom only after it has made.

We should avoid buying with leverage money because when pendulum moves towards extreme pessimism then we cannot able to know where it will stop and we get a margin call, due to the leverage. We get a disastrous outcome of such an act.

John Maynard Keynes is reputed to have said: “The market can remain irrational longer than you can remain solvent.”

When the economy is in a troublesome period and investors psychology also negative then only, we get a good asset at a bargain price.

We have a two-risk scenario – one is a risk of losing money and the other one is a risk of missing out an opportunity. Investors have to make a balance between the risk. When market moving higher in the cycle, we have to focus more on the risk of losing money and when market-moving lower in the cycle, we have to focus on the risk of losing the opportunity. When there is a high chance of losing money then we have to play defensively and when there is a chance of missing out an opportunity then we need to play aggressively.

The cycle is going to happen and how we respond to it is the key matter. Successful investors are those who have survived under the different market cycle and that cycle makes them more thoughtful.

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

Read for more detail: Mastering The Market Cycle: Getting the odds on your side by Mr.Howard Marks