Cycles in economies, companies, and markets

If we follow above points mentioned by Mr.Howard Marks then definitely we can take advantage of market cycle and able to generate above-average return.

BIBLIOPHILE: THE MOST IMPORTANT THING BY HOWARD MARKS “HAVING A SENSE FOR WHERE WE STAND”

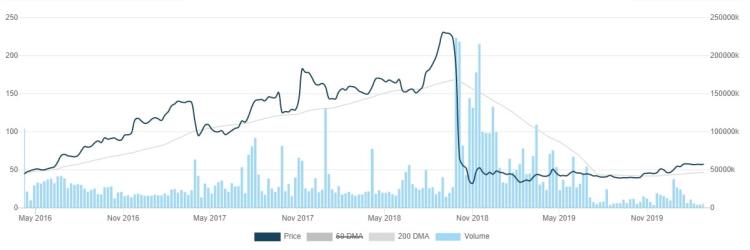

The above link will help to understand how good news flows and media get crazy with higher index targets. In the above link I have compared 2017 with 2007 and given indication in 2017 for the upcoming bubble.

Nifty 12000 – Here, we can see that the media start celebrating when the market has approached new high. Such acts motivate to retail investors and that will lead to more market participation.

We can get an indication of the market bubble when we observe our surroundings.

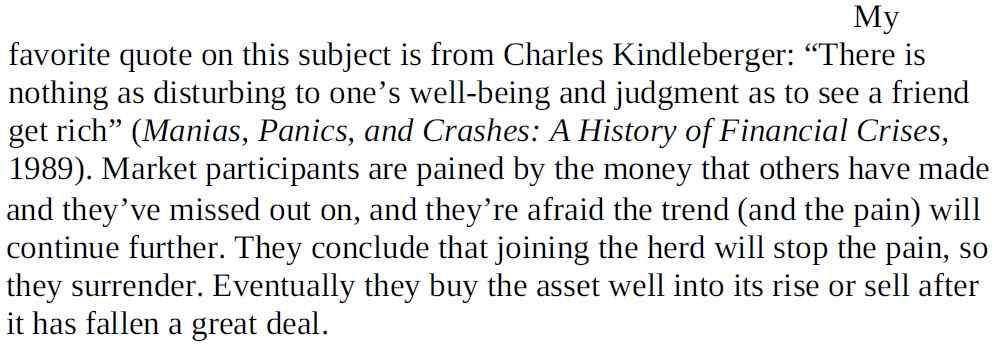

Investors try to predict bottom and still in the Fear Of Missing Out (FOMO). I am getting calls from many of people who are unaware with market, own little knowledge of market but tend to predict stock moments. They approach me with catching bottom, ask for advice (not actually, they want to get confirm with me) that they should invest right now otherwise they will miss out current opportunity.

People are involved in any of the decision-making processes whether it is in the economy, investing world, or anything else. So those human emotions also getting involved in the process. This resulted in more euphoric behavior at the wrong time and more desperate behavior at the wrong time by people. That will have resulted in the cycle. If the machine involves in the economy then it will not have a cyclical move.

The market has never moved in a straight line in the past and never will be in the future. So that we need to understand the cycle and need to take benefits from it. People think that excess bull or bear remains but that excess behaviour has to correct and that will have resulted in the cycle.

We can keep journal for events happens to our surrounding, major corporate deals, the behavior of people with us knowing that we are an investment professional, hot sectors which attracting major participation, junk starts flying, innovation in valuation matrix, etc. We cannot predict when the bubble will burst, but we can save ourselves from getting burst during bubble takes a journey towards burst. When we initially prepare ourselves for the upcoming bubble – burst then it will be going to happen that others will consider us a fool but we should accept being a fool rather than face huge damage to our wealth.

BIBLIOPHILE: THE MOST IMPORTANT THING BY HOWARD MARKS “COMBATING NEGATIVE INFLUENCES”

Disclosure – Companies mentioned in the article are just for an example & educational purpose. It is not a buy/sell/ hold recommendation.

Read for more detail: Mastering The Market Cycle: Getting the odds on your side by Mr.Howard Marks